I’m an expert programmer who lives in a third world country where I have plenty of time to develop my programming skills. I’ve mastered the forces that bring about stock market bubbles and crashes, and created software for it. My software tells you exactly when to buy stocks.

Stock market success can hinge on being able to detect subtle but important changes in the market’s behavior, and this software will help you identify such changes by allowing you to easily see when buying or selling stocks is the best course of action. It is like a valet parking service for your portfolio. The perfect gift for the active trader in your life.

We’ve developed a software system that will help you make better decisions about when to buy and sell stocks.

We know that this market is volatile, and that it’s hard to keep up with all the information out there. We also know that you’re busy, and don’t have time to stay on top of every little change in price. That’s why we built [software name].

[software name] is an AI-powered stock trading assistant that helps you make smarter decisions about when to buy and sell stocks. It takes into account all aspects of a company’s performance—from its quarterly earnings reports to its long-term prospects—and creates an analysis tailored specifically for your goals. Then it provides you with clear recommendations for how much money should be invested in each trade, as well as when those trades should be made.

You don’t have to worry about missing out on opportunities because you aren’t paying attention; [software name] will do the work for you!

If you’re trying to make money in the stock market, it’s important to know when it’s time to buy and sell. The problem is, there are lots of different signals that can tell you when a stock is going up or down, and they don’t always agree with each other. This can make things confusing for investors who are just starting out.

That’s why we created

. It’s an app that analyzes all the different signals and tells you which ones are most likely to lead to successful trades. With this information at your fingertips, you’ll be able to make smarter decisions about when to buy or sell stocks—and hopefully make more money than ever before!| #1. TradingView |

| #2. Stock Rover |

| # 3. Trade Ideas |

| #4. TrendSpider |

#5. Benzinga Pro If you want to trade news events in real-time, our analysis shows the Benzinga Pro stock program gives the reactive trader an edge in the market. The fastest and most cost-effective real-time news event trading service on the market. If you want to trade news events in real-time, our analysis shows the Benzinga Pro stock program gives the reactive trader an edge in the market. The fastest and most cost-effective real-time news event trading service on the market. |

#6. MetaStock R/T For traders seeking robust stock trading software for backtesting, forecasting, and global real-time news, our testing shows MetaStock is the market leader. MetaStock also has many add-on systems for trading momentum, candlesticks, and more. For traders seeking robust stock trading software for backtesting, forecasting, and global real-time news, our testing shows MetaStock is the market leader. MetaStock also has many add-on systems for trading momentum, candlesticks, and more. |

Best Stock Research Apps, Tools, and Software (Investment Research Software)

1. Seeking Alpha (Best for Investment Research + Stock Recommendations)

- Available: Sign up here

- Best for: Investment research, stock recommendations

Even if you only had access to the free version of Seeking Alpha, you’d be using one of the best stock research and analysis tools on the market. But we want to specifically highlight Seeking Alpha Premium, which caters to intermediate and advanced investors looking for an affordable, all-inclusive, one-stop shop for their investing needs—and currently offers a seven-day free trial.

Seeking Alpha itself has more than 16,000 active contributors sharing well-written stock analysis. In-house editors vet these pieces before being read and discussed by millions of people. Reading different opinions about the same stock helps investors develop their own informed opinions on the likelihood a stock will rise or fall. I recommend this approach when you begin learning how to research stocks.

In addition to diverse, deep-dive research articles, Seeking Alpha’s website has fundamental analysis tools, a Trending News feed, crowdsourced debates, and market data.

Users can create their own portfolios to follow favorite stocks, see how choices perform and receive email alerts or push notifications. You also have access to podcasts and video content.

While the website has a significant amount of information, some features remain reserved for the Premium Plan and Pro Plan members.

Seeking Alpha Premium

With a Seeking Alpha Premium subscription, you will enjoy unparalleled access with an ad-lite interface across your user experience.

SA Premium can help you manage your portfolio by putting you in contact with a large investing community—one that can help you research stocks and understand the financial world and provide you with ideas for your next great investment.

Premium plan members can see the ratings of authors whose articles they read. (After all, it’s useful to know whether you’re reading the opinion of someone with a top record, or someone who’s whiffing a lot.) And Premium subscribers unlock analyses from SA-designated “experts.”

“Expert” analyses are reserved for Premium members as well. This plan includes a stock screener letting you filter by average analyst rating and gain access to listen to conference calls and other presentations. Premium costs $99/year.

Seeking Alpha Premium caters to the needs of intermediate and advanced investors looking for an affordable, all-inclusive, one-stop shop for their investing needs.

Seeking Alpha Premium acts as an all-in-one investing research and recommendation service that offers insightful analysis of financial news, stocks, and more—all designed to help you make better investing decisions.

Whether you’re looking to invest on the go or dedicate time for more in-depth research and analysis, Seeking Alpha Premium provides features that meet your needs, including:

- Earnings calls transcripts

- Seeking Alpha Author Ratings and Author Performance metrics

- 10 years’ worth of financial statements

- Ability to compare stocks side-by-side with peers

- Access to dividend and earnings forecasts

- Much, much more

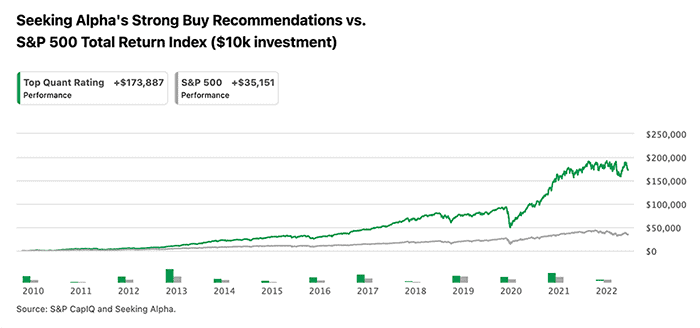

How Has Seeking Alpha Premium Performed?

SA’s Premium subscription provides full access to the service’s Stock Quant Ratings. These are collections of the best (to the worst)-rated stocks according to three independent investment resources provided on Seeking Alpha’s website. These cross checks and validations come from: (1) the Seeking Alpha Quant Model, (2) independent SA contributors, and (3) Wall Street analysts. The list of best stock recommendations gets further vetted by quantitative and fundamental analysis.

Look at the dramatic market outperformance seen by these quant-fueled “Strong Buy” stock picks as compared to the S&P 500 (total return with dividends reinvested):

Check out our Seeking Alpha Premium review to learn even more.

Seeking Alpha Pro

A Seeking Alpha Pro subscription comes with all the features of Seeking Alpha Premium, as well as a few additional goodies:

- The Top Ideas recommendation list

- Exclusive newsletter subscriptions and interviews

- VIP Editorial Concierge

- Seeking Alpha Pro screener for investing ideas

- An entirely ad-free experience

The Pro plan, which targets professional investors, is more expensive than Premium, but it does offer many features that advanced users can put to work. You can test it out with a seven-day free trial.

Why Subscribe to Seeking Alpha?

Seeking Alpha distills relevant financial information for you so you don’t have to—making it easy for anyone interested in self-directed investing to have a chance at outperforming the market.

Consider starting a seven-day free trial to take advantage of the service without cost and see if it makes sense for your needs.

Our Stock Research + Recommendation Pick

4.8

Premium: $99/yr. or $8.25/mo. (exclusive Young & The Invested pricing). Pro: $2,399.88/yr. or $199.99/mo.*

- Seeking Alpha has the world’s largest investing community.

- Seeking Alpha Premium helps you find profitable investing ideas, improve your portfolio, research stocks better and faster as well as track the news to find investing opportunities.

- Receive up to 15 investing newsletters filled with stock research and analysis, commentary and recommendations.

- Use Seeking Alpha Premium’s Seeking Alpha Stock Ratings to find stocks likely to outperform and make you money.

- Seeking Alpha Premium’s proprietary quant records have an impressive track record leading to massive market outperformance.

Pros:

- Active community of engaged investors and analysts

- Stock screeners, quantitative tools for stock analysis

- Strong track record of market outperformance on stock ratings

Cons:

- Minimal mutual fund coverage

* Promotional rate for first year. Seeking Alpha Premium regularly $239/yr. Seeking Alpha Pro regularly $2,399.88/yr. if billed annually, $3,599.88/yr. if billed monthly.

Related: Best Seeking Alpha Alternatives to Consider

2. Motley Fool Rule Breakers: Best for Long-Term Investors Looking for Growth Stocks

- Available: Sign up here

- Best for: Buy-and-hold growth investors

Motley Fool Rule Breakers focuses on stocks that have massive growth potential in emerging industries. This service isn’t fixating on what’s currently popular, but rather always looking for the next big stock.

The service has six rules they follow before making stock recommendations to subscribers:

- Only invest in “top dog” companies in an emerging industry – As Motley Fool puts it: “It doesn’t matter if you’re the big player in floppy drives—the industry is falling apart.”

- The company must have a sustainable advantage

- Company must have strong past price appreciation

- Company needs to have strong and competent management

- There must be strong consumer appeal

- Financial media must overvalue the company

In short, the service mainly looks for well-run companies in emerging industries with a sustainable advantage over competitors, among other factors.

And their rules seem to pay off, if their results are any indication.

Over the past 15 years, Rule Breakers has almost doubled the S&P 500, beating many leading money managers on Wall Street. Their results speak for themselves and easily justify the affordable price tag of $99 for the first year.

What to Expect from Motley Fool’s Rule Breakers:

When you sign up, you can expect to receive three primary items:

- A listing of Starter Stocks to begin your Rule Breakers journey with their “essential Rule Breakers”

- 5 “Best Buys Now” opportunities each month

- Two new stock picks each month

You’ll receive regular communications from the stock picking service with their analysis and rationales for buying stocks meeting their investment criteria.

If you’re unhappy with the service within the first 30 days, you can receive a full refund.

Our Stock Recommendation Pick

4.5

67% off: $99/yr.*

- Motley Fool Rule Breakers is an investment advisory service that provides insight and recommendations on potential market-beating growth stocks

- Picks are centered around emerging industries in an attempt to pick tomorrow’s stock market leaders today

Pros:

- Strong performance track record

- Discounted introductory rate

- Consistent outperformance of S&P 500

Cons:

- High-growth stocks carry volatility

- High renewal price

- Not every stock has positive returns

Stock Advisor vs. Rule Breakers

* Promotional rate for first year. $299/yr. renewal rate.

Related: Best Stock Picking Services

3. Seeking Alpha’s Alpha Picks (Best Data-Driven Stock Recommendation Service)

- Available: Sign up here

- Best for: Buy-and-holders looking for stock recommendations

Are you looking for a way to beat the market consistently? Seeking Alpha’s Alpha Picks might be a great option to consider.

Alpha Picks is a stock selection service that provides you with two of the best stock picks each month that SA determines have the greatest chance for price upside. They base their selections on fundamentals such as valuation, growth, profitability, and momentum—not hype.

The stock selection process relies on Seeking Alpha’s proprietary, data-driven computer scoring system to screen and recommend stocks for more conservative “buy-and-hold” investors.

And if results from their backtest (run from 2010 to 2022) are any indication, historical simulations of the methodology behind their strategy prove it has worked: Alpha Picks’ recommendations outperformed the S&P 500 Index by 180 percentage points (+470% for SA vs. +290% for the S&P 500).

A bit more detail about how this works: Alpha Picks relies on the existing Seeking Alpha Quant model available to Seeking Alpha Premium and Pro users, but with a bit of modification. Namely, all recommendations must meet the following criteria:

- Hold a Strong Buy Quant rating for a minimum of 75 days

- Market cap greater than $500 million

- Stock price greater than $10

- Is a publicly traded common stock (no American Depository Receipts [ADRs])

- Be the highest-rated stock at the time of selection that has not been previously recommended within the past year (Alpha Picks releases one pick at the start of the month, another in the middle).

If you sign up for the service, you can expect the following:

- Two long-term stock picks to buy and hold for at least two years, delivered every month

- Detailed explanations from Seeking Alpha behind why they rate each stock pick so highly

- Notifications when a recommendation changes

- Regular updates on current Buy recommendations

The service, designed for busy professionals interested in building a portfolio that outpaces the market but without the time to commit to finding these opportunities, is worth considering. If you’re interested, you can sign up for a discounted first-year price of $99.

Data-Driven Stock Picking Service

Seeking Alpha’s Alpha Picks | Data-Driven Stock Picks

4.3

50% discount: $99/yr.*

- Seeking Alpha’s Alpha Picks is a stock picking service designed for busy professionals who might not have the time needed to select stocks for their own portfolio

- Using a proprietary computer-scoring model, Alpha Picks makes “buy-and-hold” picks that last at least two years

- Rigorous backtesting has shown Alpha Picks’ methodology would have strongly outperformed the S&P 500 index between 2010 and 2022 (+470% vs. +290%)

Pros:

- Data-driven, computer-generated stock selection process

- Avoids human bias

- Strong backtest performance vs. S&P 500 index

- Competitive price point

Cons:

- Not enough actual performance data

- No frills, just stock picks and info about them

* Promotional rate for first year. $199/yr. renewal rate.

Related: Best Stock Investment Newsletters

4. Motley Fool Stock Advisor (Best for Buy-and-Hold Investors)

- Available: Sign up here

- Best for: Buy-and-hold growth investors

The main difference between Motley Fool’s services is the type of stock pick recommendations they provide.

Stock Advisor primarily recommends well-established companies. Over a decade ago, they advised subscribers to buy companies such as Netflix and Disney, and those picks have been extremely successful since then.

As a subscriber, you’re granted access to their history of recommendations and can see for yourself how they have done over the years.

According to their website, the Motley Fool Stock Advisor stock subscription service has returned 356% since its inception in February 2002 when you calculate the average return of all their stock recommendations over the last 17 years.

Comparatively, the S&P 500 only had a 117% return during that same timeframe.

What to Expect from Motley Fool’s Stock Advisor:

The Stock Advisor service provides a lot of worthwhile resources to subscribers.

- “Starter Stocks” recommendations to serve as a foundation to your portfolio, whether you’re a new investor or experienced

- Two new stock picks each month

- 10 “Best Buys Now” chosen from more than 300 stocks the service watches

- Investing resources with the stock picking service’s library of stock recommendations

- Access to community of investors engaged in outperforming the market and talking shop

The service charges a discounted rate for the first year and has a 30-day membership-fee refund period. Consider signing up for Stock Advisor today.

Best Introductory Stock Newsletter

4.7

55% Off: $89/yr.*

- Motley Fool Stock Advisor provides a list of five stocks they believe deserving of your money today.

- Stock Advisor also lists “Starter Stocks” they believe should serve as a portfolio’s foundation.

- Limited Time Offer: Get 55% your first year with Stock Advisor ($89 vs. $199 usual value)

Pros:

- Discounted introductory price

- Strong outperformance above S&P 500

- High overall average return for stock picks

Cons:

- High renewal price

- Not every stock is a winner

Stock Advisor vs. Rule Breakers

* Promotional rate for first year. $199/yr. renewal rate.

Get our two free newsletters to level up your money know-how and stay up-to-date:

No spam. Yeet us at any time.

5. Benzinga Pro (Best for Fast, Actionable Market News and Research)

- Available: Sign up here

- Best for: Fast market news and research

Benzinga Pro provides fast, actionable market news and stock research to investors of all kinds, from buy-and-holders to swing and day traders.

The service specializes in providing breaking news on publicly traded companies. Benzinga’s Newsfeed covers all sectors, analyst ratings changes and SEC filings from companies. You can customize these news feeds based on watchlists you create within the platform.

Benzinga’s Newsfeed covers all sectors, analyst ratings changes and SEC filings from companies. You can customize these news feeds based on watchlists you create within the platform.

Other notable Benzinga Pro features include:

- Audio Squawk: A team calls out actionable news during pre-market all the way through after-hours trading.

- Insider Trading Tracker: What are corporate insiders (company officers, big stakeholders and other important people) doing? Are they buying? Are they selling? How much do they own? This tool helps you learn more about insiders’ “skin in the game.”

- Stock Scanner: Get real-time, customized updates on the stock market.

- Charting: You can chart stocks within the Benzinga Pro platform, which uses a TradingView developer API (application programming interface).

- Calendar: Get dates for earnings reports, dividends, economic data releases, initial public offerings (IPOs), SEC filings and more.

Sign up for Benzinga Pro today and put the fastest real-time news feed, profitable trading ideas, and exclusive content right at your fingertips.

Our Fast Real-Time Market News Pick

Benzinga Pro | Fast Stock Market News

Basic: $27/mo. Essential: $177/mo. or $1,404/yr. (34% discount) if billed annually.

- Benzinga Pro is built for traders and investors to receive actionable market news and research in real-time

- Utilize Benzinga’s competitive news advantage for receiving breaking news and research to enhance your analysis

- Leverage Scanner and Charting capabilities to get customized movement updates in the stock market

6. Trade Ideas (Best for Active, Swing, And Momentum Traders)

- Available: Sign up here

- Best for: Active and swing traders

Trade Ideasemploys an artificial intelligence-powered assistant named Holly. This AI becomes your virtual research analyst who never sleeps and instead sifts through technicals, fundamentals, social media, earnings, and more to pick stocks as real-time trade recommendations.

Holly stays busy, too. She runs over 1 million simulated trades each night and morning before the markets open with more than 70 proprietary algorithms to find you the highest-probability, most risk-appropriate opportunities to invest in stocks.

This stock research and analysis tool doesn’t stop there, though. You can test these trade ideas in a live simulated trading room. This allows you to demo the stock picking service’s ideas without risking your own money.

The powerful service allows you to access real-time streaming trading ideas on simultaneous charts to learn how to trade into risk-reward balanced trades. In other words: You can invest and learn at the same time.

Where Trade Ideas Excels

Where Trade Ideas excels is not only giving you the data and ideas you haven’t seen elsewhere, but also how to manage your money. The rules-based virtual trading room on every chart plays for both long-term investors as well as active traders.

As the stock market evolves, Trade Ideas’ software adjusts levels and the trading plan to match. The best part? You can learn how to do all of this without risking your principal through a real-time simulated trading environment.

After you’ve grown comfortable with the service, you can choose to go live with the trade ideas and start investing real money by connecting directly through a brokerage like Interactive Brokers, TD Ameritrade, and E*Trade.

Additionally, the service provides alert services. You can receive price alerts through Trade Ideas’ Standard and Premium services, as well as by subscribing to the company’s Strength Alerts newsletter. This gives you five new trade ideas in your inbox from the company’s model portfolio every Monday. Trade Ideas also has a free Trade of the Week newsletter highlighting a stock pick TI has identified for subscribers.

How Does Trade Ideas Find Stock Picks?

Trade Ideas’ technology uses a different scan each week to find unusual trade activity. For example, they may detect high short interest in a stock or industry, which often leads to short squeezes, such as what happened with GameStop.

Real people curate scan results before any recommendations come available through the service. You’ll also learn how the service picked the trade, why they believe it will perform well, and how to find similar trades on your own.

The service carries a hefty price tag, with the Standard subscription starting at $999 per year. For the full Holly experience, you’ll need to upgrade to their $1,999 Premium plan.

Consider starting your Trade Ideas subscription with no contract involved. Cancel anytime.

Best Active Trader Stock Service

Trade Ideas | Your Coach and Partner for Navigating the Stock Market

4.7

Premium: $167/mo. or $1,999/yr. Standard: $84/mo. or $999/yr. Save 15% with code YATI15

- Trade Ideas is a stock market app that teaches you how to trade and invest.

- Using a simulated trading platform, you can learn how to trade and invest without risking actual money.

- The service offers a free newsletter and also AI-powered automated trading for premium subscribers.

- Special Offer: Take Trade Ideas for a Test Drive. Using this $11.11 full, 2-week trial lets non-subscribers or standard subscribers enjoy all Premium Subscription features.

Pros:

- Free live trading room that delivers actionable guidance

- In-browser and desktop interface functionality

- Automated trading capabilities

- AI-powered trade suggestions

Cons:

- No mobile app

- Pricey subscriptions for some traders

- Cannot place actual trades through TI

7. Morningstar (Best Research Tools for Fund Investors)

- Available: Sign up here

- Best for:Fund research, research reports

Morningstaris a popular resource for investors looking to find, evaluate, and monitor investments that best meet their interests and needs.

This investment research site has provided mutual fund, ETF and stock research for almost four decades and prides itself on its independence and reputation for objectivity. Investors seeking out the best funds for their portfolios should be plenty familiar with the site’s Morningstar Star and Medalist ratings.

The paid Morningstar Investor service includes access to its independent analysis, stock screeners, in-depth market observations, and Portfolio X-Ray, which evaluates all your holdings through various lenses: sector weightings, fees, asset allocation, and more.

Morningstar Investor also has a stellar deal for students, offering one year of access for just $25. That’s roughly 90% off the normal price!

Free 7-day trial. $199/yr.*

- Morningstar Investor offers expert research and investing advice. The service prides itself on its objectivity, top picks and advisor-grade portfolio management tools.

* Promotional rate for first year. $249/yr. renewal rate.

8. Stock Rover

- Available: Sign up here

- Best for: Proprietary research scoring, read-only data feed of your portfolio holdings

Stock Rover is more appropriate for self-directed investors who want to discover their own opportunities and manage their own portfolios.

The service allows you to create real-time research reports that provide a full fundamental and technical overview of a company’s performance. Stock Rover also provides comprehensive ticker, index, portfolio, and watchlist alerts; a real-time stock screener; and robust charting capabilities.

Stock Rover also is a powerful portfolio tracker, offering brokerage integration, detailed performance information, emailed performance reports, in-depth portfolio analysis tools, correlation tools, trade planning and re-balancing facilities.

This service works as a web-based applet and offers a number of useful services and applications, depending on your research and analysis needs.

One of the best features of the web-based app is Stock Rover’s “Brokerage Connect.” This provides you with a read-only data feed of your portfolio holdings. This shows you a comprehensive view of your portfolios, whether they’re in one brokerage account or spread across numerous investment accounts. This view makes Stock Rover one of the best stock tracking and portfolio management apps.

After syncing your brokerage accounts to Stock Rover, details for each portfolio get populated in your Stock Rover dashboard for in-depth analytics and tracking purposes.

Consider signing up for Stock Rover with a free 14-day trial. From there, you can decide if you’d like to upgrade to the service’s premium plans for more robust tracking and analysis.

Our Stock Research Tool Pick

Stock Rover | Tools for Investors

4.1

Essentials: $7.99/mo. or $54.99/yr. Premium: $17.99/mo. or $124.99/yr. Premium Plus: $27.99/mo. or $194.99/yr.

- A complete service for investors looking to use screeners, investment comparisons, real-time research reports, model portfolios, chart and more

- Use this top-rated investment analytics service to identify stocks worth buying and outperforming the market

Pros:

- Hundreds of screening metrics

- Proprietary scoring systems

- Real-time executive summary research reports

Cons:

- No mobile app

- No crypto or forex data

- US markets only

Top 5 Features Video Explainer

9. EquitySet (Platform of Stock Market Research Tools)

- Available: Sign up here

- Best for: Visualizations, simple user interface

Investing in stocks can be a daunting task. There are so many different factors to consider, and it’s easy to get overwhelmed.

EquitySet is here to help! The company provides unbiased stock reports that will help you make the best investment decisions possible.

This platform of stock market research tools also provides simplified data with beautiful UI outputs for your convenience. No credit card required—just sign up for free today!

The platform covers 8,000-plus stocks and ETFs, so it has everything you need to find the perfect investment opportunity. You’ll never have to worry about FOMO again!

Get started now by signing up to a free seven-day trial of EquitySet Premium today!

EquitySet | Platform for Retail Investors

- EquitySet offers a platform of stock market research tools useful to retail investors

- Unbiased research reports with ratings, fair value calculations, historic data and unique insights on financials, earnings and dividends

10. MarketXLS

- Available: Sign up here

- Best for: Excel-based stock analysis and research

MarketXLS helps investors conduct technical and fundamental analysis on exchange-traded securities.

MarketXLS is an Excel-based investment research tool which allows you to look deeper into stocks, ETFs, options, mutual funds, currencies with streaming market data.

The live stock quotes flow through Excel formulas to get the most accurate prices, fundamentals, key ratios, estimates, returns, and custom-calculated data points.

MarketXLS offers more than 120 technical indicators, including:

- Relative Strength Indicators

- Double Exponential Moving Average

- Exponential Moving Average

- Kaufman Adaptive Moving Average

- MESA Adaptive Moving Average

- Average Directional Movement Index

- Absolute Price Oscillator

- Hilbert Transform—Dominant Cycle Period

- Chaikin A/D Line

- Several Pattern Recognitions

- Linear Regression

- Time Series Forecast

- Variance

- Weighted Close Price

- Bollinger Bands

In short, MarketXLS makes it easy to research, track and invest in the stock market using valuable technical and fundamental analysis tools. This brings data and tools into a familiar environment: Excel spreadsheets.