It’s easier to get a business project off the ground when you have access to the necessary funds. You can get a bank loan, and that’s what many entrepreneurs take advantage of. However, there’s quite a bit you need to do before your application is approved.

If you’re looking for a business loan to help get your business off the ground, the first step is to create a business plan. A good business plan can make or break your chances of getting funding. But with so many components involved it often becomes difficult to know where to start. Here are a few tips to creating a solid plan that could help you win over the heart and mind of a banker, sample business plan for bank loan and sample business loan proposal letter!

How to prepare a business plan for a bank loan

If you need funding to start, expand, or acquire a business, you’ll need to know how to write a business plan for a loan. Yes, lenders will look at the standard factors required of all loan applicants, such as your credit history, credit score, and assets — But business loan lenders will also require a business plan.

Why do you need to know how to write a business plan for a bank loan? Because banks want to know your business idea will be viable and sustainable. To assess its viability, they look at all aspects, including financial statements, sales strategies, and your overall financial plan. Your financial projections are key — a good business plan will include several years’ worth of past revenue and profits (if available). It will also forecast sales and profits three to five years into the future. Lenders also want to know what the business is, what products you offer, what the competitive landscape looks like, and who your key personnel are. This information (and more) is used to gauge your business’s chances of success, which will ultimately allow you to succeed and to make loan payments to the lender.

While a business plan for a loan should be clear and comprehensible to loan officers, writing a business plan for a loan also benefits you as the owner. A well-executed business plan serves as a guide to your business. You can use the past financials and the forecasts as blueprints to determine whether you are on track for success, for example.

Tip: When you create a business plan to get a loan, remember you are also writing a document that can be used as a forecast and guide for yourself and your business.

What Does a Successful Business Plan Include?

A strong business plan for a loan application will include the following elements:

- Cover Page and Table of Contents

- Executive Summary

- Company Description

- Market Plan and Analysis

- Organization and Management

- Service or Product

- Marketing and Sales

- Financing Analysis

- Funding Request

- Appendix

Many lenders may still be looking critically at how your business will operate during the COVID-19 pandemic. Lenders are primarily looking at two criteria:

- How the business’s revenue will continue under COVID-19 restrictions and effects.

- How a borrower will safely operate their business.

We recommend adding a “COVID-19” section to your business plan. It doesn’t need to be very lengthy, but it should cover how you plan to keep a safe and sanity working environment for your staff and customers. Place it in or after your Organization and Management section. The information to include is:

- Restricting occupancy

- Stocking up on cleaning supplies and hand sanitizer

- Wearing masks, gloves, or other safety gear

- Wiping down equipment – for example, a fitness facility might wipe down equipment every hour

To address concerns about revenue, include information such as:

- If your state has allowed your industry to reopen

- New or alternative ways to earn revenue if you can’t open a physical location

If you’re looking to open a franchise, make sure to check with your franchisor to learn what protocols for their franchisees they’ve put in place. Lots of franchises have been adding mandatory safety steps for franchisees to put in place.

1. Cover Page and Table of Contents

Your business plan for a loan application is a professional document, so be sure it looks professional. The cover page should contain the name of your business and your contact information. If you have a logo, it should go on the cover.

Both lenders and you will appreciate a table of contents and page numbers in the business plan for a loan application, so they can quickly find specific sections. If you are delivering your plan digitally and not physically, be sure your table of content is clickable and links readers to the correct sections.

2. Executive Summary

It’s common for business documents to carry executive summaries at the beginning so that busy people have the key takeaways from a larger document immediately at hand. Your reader shouldn’t feel they have to wade through a large document for crucial information.

Briefly summarize the entire business plan on a page. Describe the company, your product, and why you started the company. Include your chief competitors and why your product will succeed against them. If relevant, discuss the economic climate vis-à-vis your customers and products.

Tip: The executive summary shouldn’t include a great deal of financial information. If you have a particularly relevant or striking financial result, it can be included.

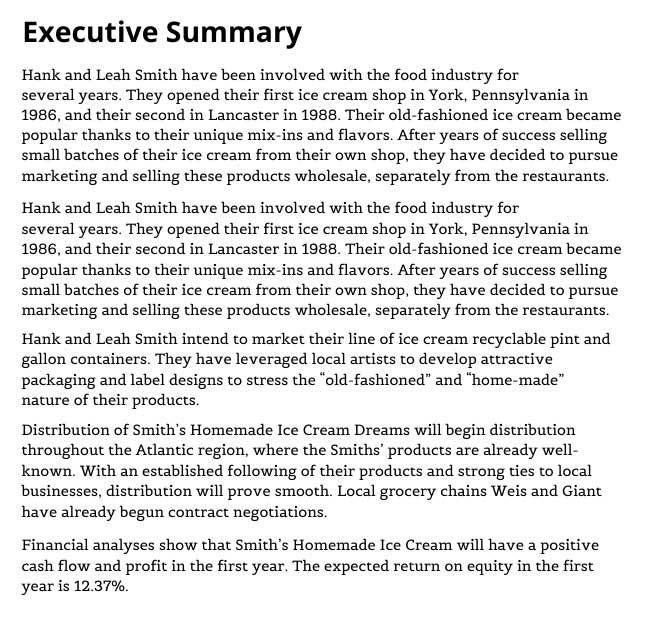

Example of an executive summary.

3. Company Description

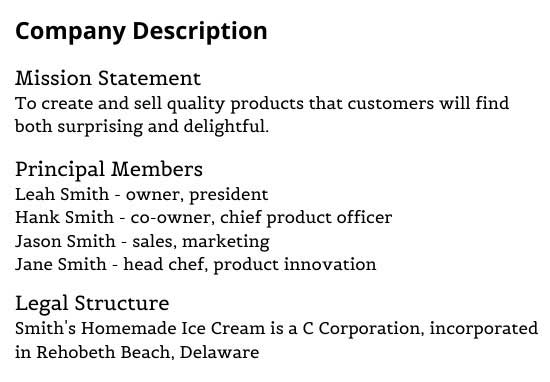

The company description should include a mission statement, the company principles, any strategic partners, and your corporate structure. It will be relatively short.

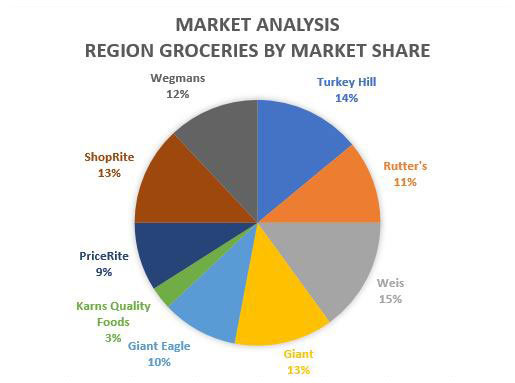

4. Market Analysis

After you’ve told the lender what your company does and who does it, you’ll want to provide a competitive analysis of your market. Let’s be clear: the market analysis is not a full marketing plan. That will come later. The market analysis focuses on the qualities of the market, not a detailed plan of how you’ll capture it. Identify the existing gaps that your business will fill. A business plan’s market analysis should include:

- An industry overview and outlook

- Any differentiation in sector and niche

- Information on your target market

- The company’s marketing strategy and how it will make your company stand out

The market analysis should also specify the effect of outside sources on your company. For example, if the industry is subject to regulation, include information indicating your knowledge of the regulation and your past compliance with it (if your business is already up and running). Will you require raw materials? If so, how do you guarantee you’ll have them at costs that support your financials? Are there any risks to price points changing?

What about your competitors? How do they differentiate themselves? What is their pricing strategy?

While your market analysis will include information on your competitors, the real focus should be on your target customers. Where do they currently shop? Why? How old are they? What are their beliefs? What’s their current average income? Perhaps there is more than one type of customer, in which case you should include details about both customer segments. Showing investors you have mastery over your ideal customer adds confidence in your ability to succeed.

If your company is engaged in ongoing market research or research and development for competitive new products and services, indicate it in this section. Does your research include customer interviews? How are you ensuring that your research is credible?

The market analysis should be based on reputable sources. When describing your competitors and their products, for example, it should be clear to readers where the information comes from.

Tip: Many business owners engage third-party companies to perform an analysis. If you have, be sure to cite them. If your information comes from published research or a survey, be sure to cite those as well.

5. Organization and Management

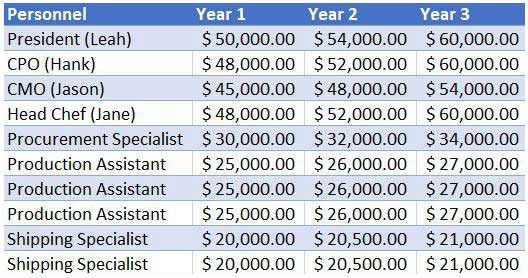

The organization and management section should itemize your company’s management structure. Many business plans provide an organizational chart, a structure description, and salary forecasts.

The description should include each management position, the person in the position, their responsibilities, and their qualifications. If you have a Board of Directors, list them on a separate page, along with any experience relevant to your business’s success.

The principals of the firm, such as the owner and co-owners, are included in the business description section. If your company is small and currently contains only the principals, it isn’t necessary to include a separate organization and management section.

6. Service or Product

Now it’s time to describe your company’s product or service in detail. What do you sell, and who do you sell to? What exactly is your business model? What need are you fulfilling for the customer base? Business plans often itemize their entire product line with the planned or current pricing structure.

The service or product section should also include your product/service’s estimated lifecycle, and any research and development completed, in progress, or planned. Naturally, this section will vary greatly depending on your type of business. It should also include a description of any trademarks, patents, or other intellectual property rights, if applicable.

See an example of a service and product section here.

7. Marketing and Sales

The marketing and sales section includes three vital pieces of information:

- How will customers find out about your products?

- What will your sales channels and methods be?

- What is your growth strategy?

If you plan for customers to discover your products or services through informational methods like industry meetings, specify what your plan for that method is. If you plan to advertise or develop a public relations campaign, specify what your efforts will be. Will you be on social media channels? Which ones, and why? Are these efforts designed to appeal to specific demographics or types of customers? Which ones, and why? Will sales be accomplished via a targeted sales team? Will management call upon relevant prospective clients or stores? Will you have an online presence?

If you have a growth strategy, outline it. If you plan expansions to other geographic areas or other types of potential customers, discuss it in this section.

See an example of a marketing and sales section here.

8. Financial Analysis

The financial analysis section is key for lenders. The financial analysis must include financial projections for three to five years out. The further out into the future forecasts run, of course, the more difficult it is to predict with certainty. One solution is to prepare a business plan with three-year forecasts, but have a five-year forecast ready if the investors want them.

Tip: If you are already in business, you should also include historical results for the past three to five years (or for as long as the business has been operating, if it’s less).

The financial projections must include:

- Income statements

- Cash flow statements

- Capital expenditure budgets

- Balance sheets

They may also include profit and loss statements, sales forecasts, and financial metrics relevant to your industry. Lenders may ask you for more granular data, such as cost of sales or cost per product (or service).

You need to provide the projections by month, quarter, and year. Potential investors want to see the financials in both the short and long term. Why? Because businesses that aren’t meeting their monthly and quarterly projections can be risky. If they are falling behind in sales or profit, for example, they can fail rapidly.

On the other hand, if sales are much greater than projected, the company can find it challenging to keep up with production and other efforts. To counterbalance the risk, lenders always want a clear picture of what’s likely to happen.

See an example of a financial analysis section here.

Need funding? We can get your dream off the ground.

Get Started!

8.2 Break-even Analysis

A break-even analysis is the calculation and study of the margin of safety of a company, based on revenue and associated costs.

Learn how to calculate break-even analysis in Excel here.

8.3 Projected Profit and Loss

Also known as a P&L forecast, this section will cover the projection of how much money your company will bring in and how much profit you’ll make from those sales.

Tip: Most accounting software, like QuickBooks or Peachtree, can create a P&L forecast for you after you enter sales and expenses.

8.4 Cash Flow Forecast

A cash flow forecast documents your estimate of how much money will come in and out of your business within a specific amount of time (usually 12 months). The forecast includes your projected income and expenses.

Learn more about how to model your cash flow forecast here.

Tip: Looking at your past cash flow through accounting software can help you determine your future cash flow and forecast it.

8.5 Projected Balance Sheet

A projected balance sheet is also known as a “pro forma” balance sheet. It lists out account balances on a company’s assets, equity, liabilities, and other spending and income that the P&L doesn’t cover – like cash from a loan or outstanding customer invoices.

Learn more about how to create a pro forma balance sheet here.

Learn how to create a company balance sheet and download a template here.

8.6 Business Ratios

Ratios in a business plan are used to assess and analyze the performance of a business. In this case, projected ratios are another good look for banks to understand your business’s potential and also serve as a goalpost for your planning.

Common Business Ratios (and Their Formulas)

Net Profit Margin

Formula: Net Profit After Taxes / Net SalesGross Profit Margin Ratio

Formula: Gross Profit = (Revenue – Cost of Goods Sold) / RevenueProfit Margin Ratio

Formula: Profit Margin = (Revenue – Expenses) / RevenueQuick Ratio (also known as “The Acid Test”)

Formula: Quick Ratio = (Cash + Marketable Securities + Accounts Receivable) / Current Liabilities

OR

Formula: Quick Ratio = (Current Assets – Inventory) / Current LiabilitiesROI (Return on Investment) Ratio

Formula: ROI Ratio = (Gain from Investment – Cost of Investment) / Cost of InvestmentCurrent Ratio

Formula: Current Ratio = Current Assets / Current LiabilitiesCommon Size

Formula: Common Size Ratio = Line Item / Total

9. Funding Request

Now it’s time for your funding request! You need to clearly itemize why you need business financing, what amount you’re requesting (both current and prospective for the next five years), and what you will use the amounts for.

Tip: Describe how funding will contribute to the overall success of your company (and its strategic plan). Will it allow strategic R&D? Provide funds to acquire a smaller competitor? Create an opportunity for media buys and other marketing?

Here’s one way you can structure your funding request:

- Your current funding needs.

- Any future funding requirements over the next five years.

- How you intend to use the funds you receive.

- Any strategic future financial plans.

10. Appendix

Appropriate appendix materials include:

- Principals’ resumes

- Tax returns

- Relevant real estate documents

- Documents detailing the legal structure of your business

- Processing flowchart

- Letters of intent to purchase from buyers

- Advertisement and marketing materials

- Relevant training certificates

- Sales forecast

- Other financial forecasts

- Personnel plan

- Profit and loss statement

- Balance sheet

sample business plan for bank loan

Step 1: Outline The Opportunity

This is the core of your business plan. It should give loan officers a clear understanding of:

- What problem you’re solving

- How your product or service fits into the current market

- What sets your business apart from the competition

There are three key parts to this step:

The Problem & Solution

Detail exactly what problem you are solving for your customers. How do their lives improve after you solve that “pain point” for them?

We recommend actually going out and chatting with your target audience first. That way, you can validate that you’re solving a real problem for your potential customers.

Be sure to describe your solution in vivid detail. For example, if the problem is that parking downtown is expensive and hard to find, your solution might be a bike rental service with designated pickup and dropoff locations.

Target Market

Who exactly are you selling to? And roughly how many of them are there?

This is crucial information for determining whether or not your business will succeed long–term. Never assume that your target market is “everyone.”

For example, it would be easy for a barber shop to target everyone who needs a haircut. But most likely, it will need to focus on a specific market segment to reach its full business potential. This might include catering to children and families, seniors or business professionals.

Competition

Who are your direct competitors? These are companies that provide similar solutions that aim to solve your customers’ pain points.

Then outline what your competitive advantages are. Why should your target market choose you over the other products or services available?

Think you don’t have any competition? Think again. Your customers are likely turning to an indirect competitor that is solving their problem with a different type of solution.

For example: A taco stand might compete directly with another taco stand, but indirectly with a nearby hot dog vendor.

Boost your chances of securing a loan

See how LivePlan can help you write a fundable business planSee how LivePlan works

Step 2: Show how you’ll execute

This is where the action happens! Here you’ll get into the details of how you’ll take advantage of the opportunity you outlined in the previous section. This part demonstrates to banks that you have a strong plan to achieve success.

The three main components of this step include:

Marketing & Sales Plan

There can be a lot of moving parts to this one, depending on your business model.

But most importantly, you’ll need to fully explain how you plan to reach your target market and convert those people into customers. A few example of what should be included:

- Positioning strategy. What makes your business both unique and highly desirable to your target market?

- Marketing activities. Will you advertise with billboards, online ads or something else entirely?

- Pricing. What you charge must reflect consumer demand. There are a few models to choose from, including ‘cost–plus pricing’ and ‘value pricing.’

Operations

This is the nuts and bolts of your business. It’s especially important for brick–and–mortar companies that operate a storefront or have a warehouse.

You may want to explain why your location is important or detail how much space you have available. Plan to work at home? You can also cover your office space and any plans to move outside your house.

Any specialized software or equipment and tools should also be covered here.

Milestones & Metrics

Lenders and investors want to be confident that you know how to turn your business plans into financial success. That’s where your milestones come in.

These are planned goals that help you progress your company. For example, if you’re launching a new product your milestones may include completing prototypes and figuring out manufacturing.

Metrics are how you will gauge the success of your business. Do you want to generate a certain level of sales? Or keep costs at a certain level? Figuring out which metrics are most important and then tracking them is essential for growth.

Step 3: Detail your financial plan

This is the most crucial – and intimidating – part of any business plan for a bank loan. Your prospective lender will look especially close at this section to determine how likely your business is to succeed.

But the financial section doesn’t have to be overwhelming, especially if you break the work into smaller pieces. Here are 3 items that your plan must have:

Forecast

Simply put, this is your projections for your business finances. It gives you (and the bank) an idea of how much profit your company stands to make. Just a few items you’ll need to include:

- Revenue. List all your products, services and any other ways your business will generate income.

- Direct costs. Or in other words, what are the costs to make what you sell?

- Personnel. Salaries and expenses related to what you pay yourself, employees and any contactors.

- Expenses. Things like rent, utilities, marketing costs and any other regular expenses.

Financing

Exactly how will you use any investments, loans or other financing to grow your business? This might include paying for capital expenses like equipment or hiring personnel.

Also detail where all your financing is coming from. Lines of credit, loans or personal savings should be listed here.

Statements

Bankers will be giving this section a lot of attention. Here’s what you’ll need:

- Profit & Loss. This statement pulls in numbers from your sales forecast and other elements to show whether you’re making or losing money.

- Projected Balance Sheet. This is likely the first thing a loan officer will look at: it covers your liability, capital and assets. It provides an overview of how financially sound your business is.

- Projected Cash Flow. Essentially, this statement keeps track of how much money you have in the bank at any given point. Loan officers are likely to expect realistic monthly cash flow for the next 12 months.

sample business loan proposal letter

1. Sample Business Loan Proposal for Bank

floridasbdc.org

Details

File Format

- DOC

Size: 62 KB

DOWNLOAD

The first thing that most businesses turn to when they need to get a loan, especially if it is for a really huge amount, is a bank loan. Banks offer different kinds of loan for varying amounts depending on the capability of the borrower to pay the loan and the requirements they can present upon application. A business loan proposal is one of these requirements, and banks use this as one of their basis for approving or denying your loan. Being a known business entity is one factor, but a well-written, feasible, and persuasive business proposal is actually what gets the deal done.

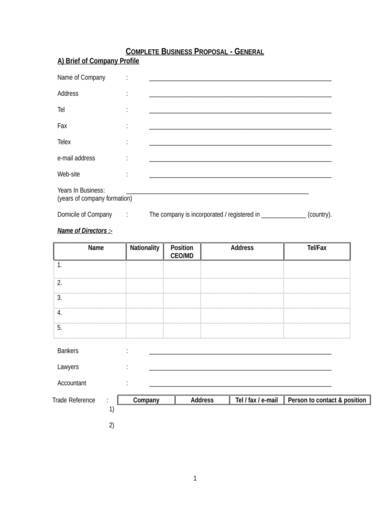

2. Sample Complete Business Loan Proposal

www137.pair.com

Details

File Format

- DOC

Size: 10 KB

DOWNLOAD

Why do we say that this business loan proposal template is complete? That is because it includes all of the necessary details that will complete a proposal. Since this sample template is also customizable, you can easily make the necessary changes to make a proposal that is applicable to your needs. There are fill-in-the-blanks and questions that will help you come up with a detailed proposal so you don’t have to worry about missing anything. It’s definitely a great professional business proposal template to use.

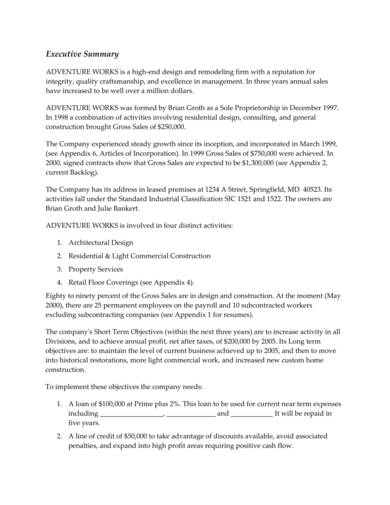

3. Bank Loan Request and Proposal Sample

fitsmallbusiness.com

Details

File Format

Size: 131 KB

DOWNLOAD

Planning to get a bank loan for your business? Then you should learn how to write a bank loan request and proposal. Banks follow really strict guidelines when it comes to lending money to their borrowers. Having knowledge on how to come up with a presentable proposal would be to your advantage. This sample includes a writing guide followed by a brief proposal sample that you find useful.

4. Sample Proposal for Microenterprise Development and Loans

globalgiving.org

Details

File Format

Size: 605 KB

DOWNLOAD

A microenterprise is defined as very small scale business that consists of six employees or lesser. You can’t expect to earn a ton with this kind of business, not with the workforce that you have. Even if that is the case, you may still encounter financial difficulties in starting one. This sample proposal for microenterprise development and loans will be a helpful reference to use when writing a proposal for a microenterprise loan. It works just like a business investment proposal on a small scale.

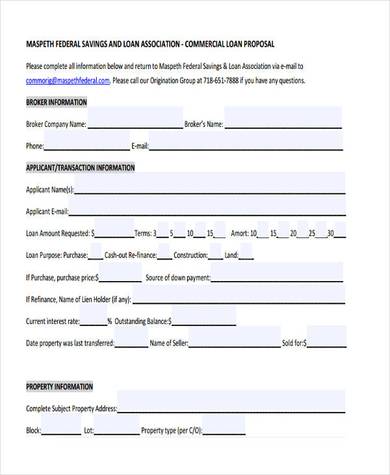

5. Commercial Business Loan Proposal Sample

maspethfederal.com

Details

File Format

Size: 1 MB

DOWNLOAD

This commercial business loan proposal sample template will surely make it easier and more convenient for you to write an effective and persuasive business proposal of your own. The template has every detail that you need, which includes broker information, applicant transaction or information, property information, income information, a list of commercial tenant information, and yearly building expense information. For your commercial business loan needs, this proposal is sure to be a good choice.